Property damages is utilized to spend for damages triggered to the various other celebration's automobile as well as for various other building such as electric posts and also street lights. Unlike responsibility insurance coverage that is used to spend for losses to others, is made use of to deal with or replace your automobile if it's harmed in an accidental accident with an additional automobile or object. vans.

It likewise protects you as well as relatives living in your household that are harmed in somebody else's vehicle, or by a car as pedestrians. While there may not be a set interpretation of full insurance coverage insurance, AAA offers a series of to fit your needs (cheaper). Consider your options and talk with a AAA insurance agent for responses that can assist you select the most effective insurance coverage at one of the most economical cost.

You and household members listed on the policy are additionally covered when driving somebody else's vehicle with their permission - perks. It's extremely vital to have enough liability insurance, because if you are entailed in a serious crash, you might be filed a claim against for a huge sum of cash. It's suggested that insurance holders buy even more than the state-required minimum responsibility insurance policy, sufficient to shield assets such as your home as well as cost savings - cheaper.

cheap car insurance insurance companies cheaper car insurance insurance companies

cheap car insurance insurance companies cheaper car insurance insurance companies

cheaper car insurance company vehicle insurance laws

cheaper car insurance company vehicle insurance laws

At its widest, PIP can cover clinical payments, lost salaries and also the expense of replacing services normally done by a person hurt in an automobile crash. It might additionally cover funeral prices. cars. Property damages responsibility This protection pays for damages you (or somebody driving the auto with your approval) might create to another person's building.

Accident Accident coverage spends for damage to your automobile arising from an accident with an additional automobile, an object, such as a tree or telephone pole, or as a result of turning over (note that accidents with deer are covered under comprehensive). It likewise covers damages triggered by potholes. cheaper auto insurance. Accident coverage is usually sold with a different insurance deductible. cheapest.

What Is Full Coverage? - Allstate - Questions

If you're not at fault, your insurance provider might try to recoup the quantity they paid you from the other vehicle driver's insurance provider as well as, if they achieve success, you'll additionally be compensated for the insurance deductible. Comprehensive This insurance coverage repays you for loss as a result of burglary or damages triggered by something apart from an accident with another cars and truck or item - cars.

Purchasing auto insurance coverage? Here's just how to discover the ideal plan for you and your car..

cheapest car cheapest car car insured dui

cheapest car cheapest car car insured dui

The ordinary cars and truck insurance policy price for full insurance coverage in the United States is $1,150 per year, or about $97 per month (cheap auto insurance). A 'complete coverage car insurance coverage' plan covers you in most of them.

A complete insurance coverage policy depending on state regulations might also cover without insurance motorist protection and a clinical protection of injury security or medical repayments. A regular full protection insurance coverage will certainly not cover you as well as your cars and truck in every circumstance. It has exemptions to details incidents (perks). IN THIS ARTICLEWhat is complete coverage vehicle insurance policy? There is no such thing as a "complete insurance coverage" insurance coverage policy; it is merely a term that refers to a collection of insurance policy protections that not only includes liability insurance coverage however collision and also comprehensive. low cost auto.

money affordable auto insurance insurance companies automobile

money affordable auto insurance insurance companies automobile

What is taken into consideration complete insurance coverage insurance coverage to one driver may not be the exact same as also one more chauffeur in the exact same home. Preferably, complete insurance coverage implies you have insurance policy in the types as well as quantities that are appropriate for your earnings, assets and also risk profile. cheap insurance. The factor of all kinds of car insurance coverage is to maintain you from being monetarily ruined by a crash or event.

Not known Incorrect Statements About What Is Full Coverage Car Insurance? - Auto Trends Magazine

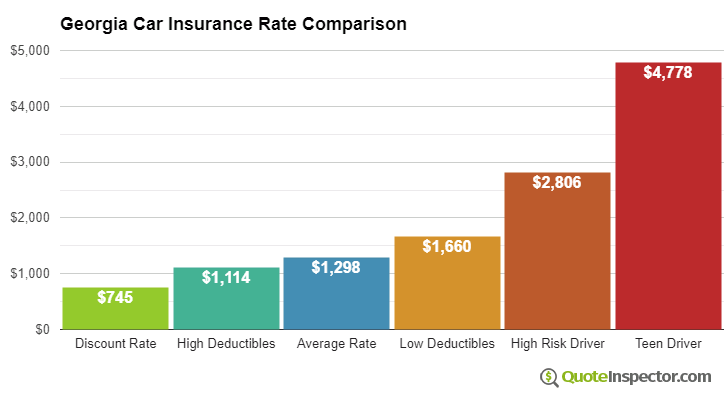

Fees additionally differ by hundreds or perhaps thousands of bucks from firm to business - Additional resources cheap auto insurance. That's why we always suggest, as your first step to conserving cash, that you contrast quotes (cheapest auto insurance). Right here's a state-by-state contrast of the average yearly price of the complying with protection degrees: State-mandated minimal liability, or, simplistic insurance coverage required to lawfully drive a cars and truck, Complete coverage liability of $100,000 each harmed in a crash you cause, approximately $300,000 per mishap, and $100,000 for residential property damage you create (100/300/100), with a $500 deductible for detailed and accident, You'll see just how much full insurance coverage car insurance policy prices monthly, as well as each year (insure).

The ordinary annual price for complete protection with higher responsibility limitations of 100/300/100 is around $1,150 greater than a bare minimum plan (low-cost auto insurance). If you select lower responsibility limitations, such as 50/100/50, you can conserve however still have respectable protection (insurance companies). The typical monthly expense to improve protection from state minimum to complete insurance coverage (with 100/300/100 limits) is about $97, but in some states it's much less, in others you'll pay more (cheap car).

Your automobile, up to its fair market price, minus your deductible, if you are at mistake or the other chauffeur does not have insurance or if it is destroyed by a natural calamity or taken (compensation and collision)Your injuries and of your passengers, if you are struck by a without insurance motorist, up to the restrictions of your uninsured vehicle driver policy (without insurance motorist or ) - affordable auto insurance.